Meal kits: the good, the bad and the ugly

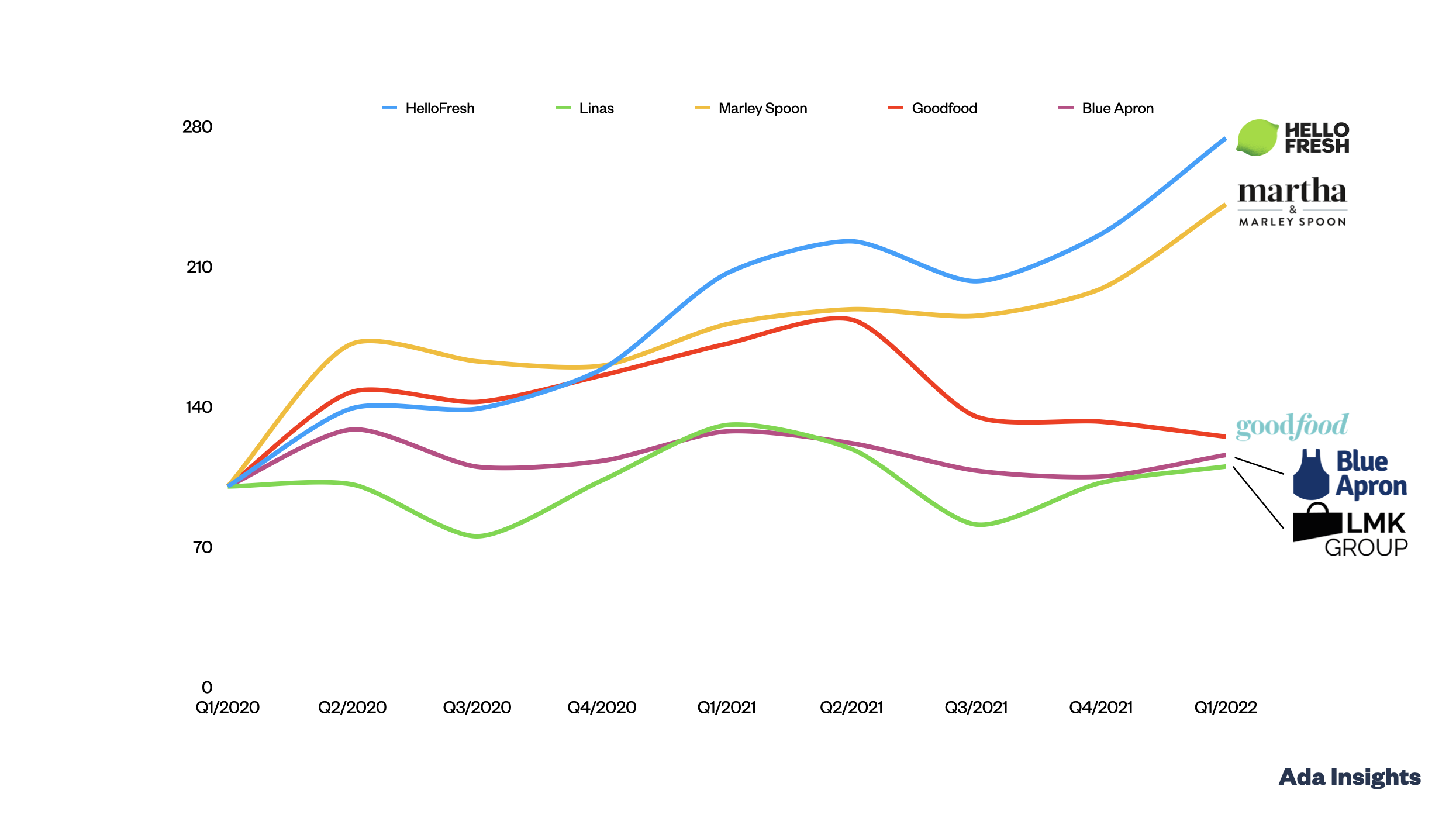

Sales indices for selected meal kit companies (Q1/2020 = 100)

Prior to pandemic meal kits had started to fade in popularity in the retail press. Especially the fading glory of Blue Apron lead some to argue that meal kits were only a fad.

Pandemic turned the fortunes of meal kit companies. Most of them flourished big time in 2020 and 2021. However, that growth can also be difficult to maintain. These difficult comparison figures are a way to separate the well run meal kit companies from the rest.

The best performers

HelloFresh and Marley Spoon have been performing much better with the high comparison numbers from the pandemic times. HelloFresh stands miles apart from the other meal kit providers, because of its sheer size.

HelloFresh is more than 12 times bigger than it’s next biggest rival Blue Apron.

The original ones struggling

Blue Apron and Linas Matkasse are among the early meal kit success stories, which have been struggling over the last years. They both saw at least modest jump in revenues during the Covid, but have seen 6-9 months of declining revenues.

Goodfood pivoting to groceries & rapid delivery

Canadian meal kit provider Goodfood has grown rapidly, but struggled before and during the pandemic. However, after the pandemic the company has struggled for the last 9 months. Goodfood revenues have come down by -32%.

During these struggles, Goodfood has followed HelloFresh in starting to sell groceries and ready meals alongside the traditional meal kits. Goodfood has went so far as to open Micro Fulfilment Centers (MFC) for really fast on-demand deliveries of up to 30 minutes from the order.

It will be very interesting to see whether the combination of meal kits and fast grocery deliveries are a way for Goodfood to turn back to the growth path.