BHG and Kesko and the plummeting DIY revenues

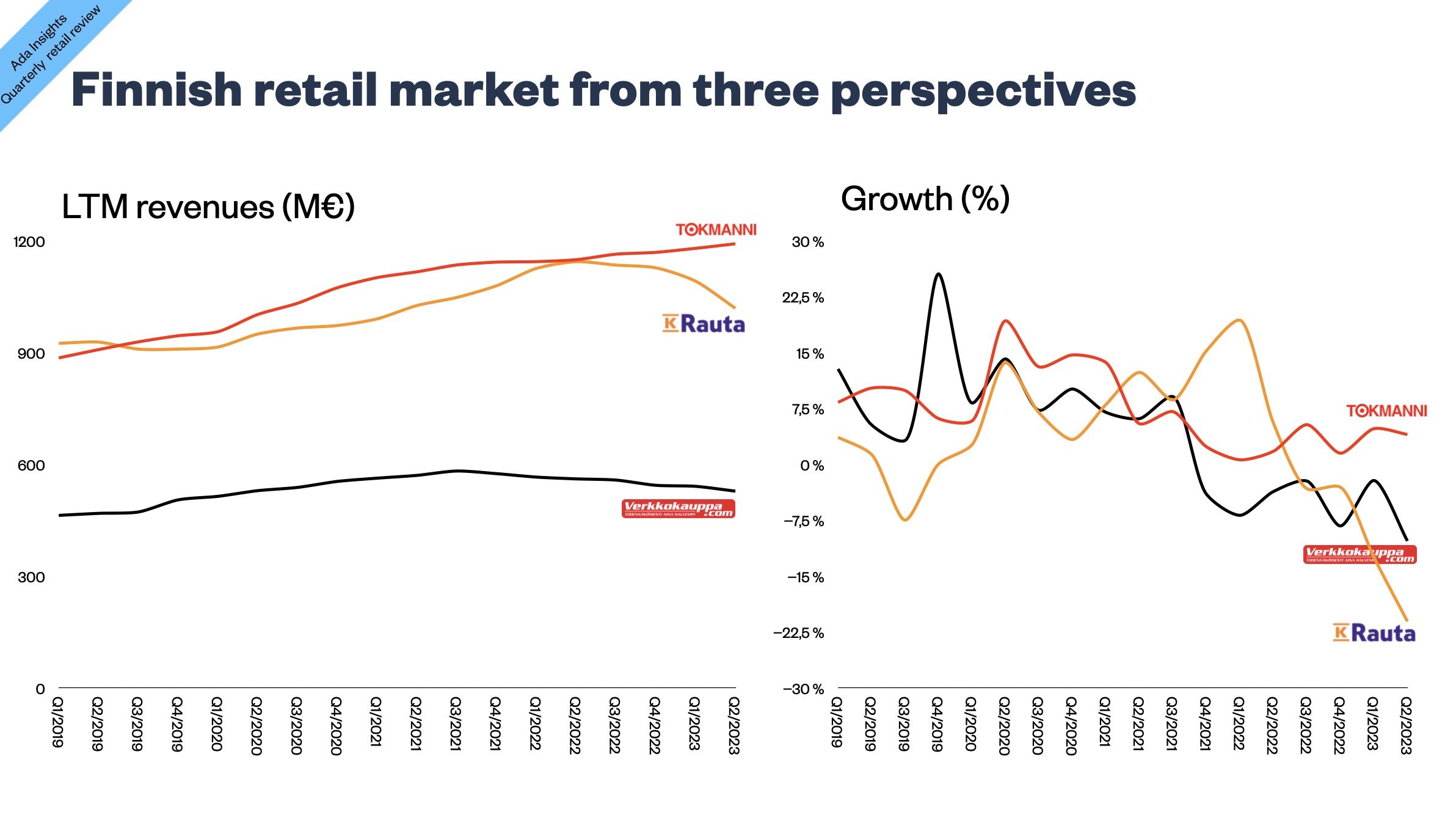

The DIY sector has gone from being the darling of the retail industry during the pandemic to being the most challenged sector. Two Nordic DIY retailers, Kesko and BHG, reported their Q4/2023 results. The results did not paint a picture of a sector returning to growth. The trading environment seems to remain challenging. This is highlighted by the big challenges of both fo these Nordic companies.

Kesko and BHG have had challenging times during the last 1,5 years, with revenues declining sharply, especially during the last year. Q4/2023 didn't produce meaningful help for the retailers as the decline seems to accelerate in many markets and channels.

Even the highly profitable and rapidly growing B2B arm of Kesko, Onninen, has started to decline in revenues.

Kesko DIY is going deeper into a decline

The Building and home improvement trade within Kesko has been the major growth story for the company. During the pandemic, the segment grew revenues and especially profits healthily. Lately, it has suffered from the slowdown of construction activity in Northern Europe. The B2C part of the Building and home improvement trade has seen six consecutive quarters of sales decline.

This has impacted profitability. In Q4/2021, the business segment reported a profit margin of 5,3%. In Q4/2023, that was diminished into a 1,2% profit margin.

During the last year, the profits from the consumer side of the Building and home improvement trade has declined by a whopping -60%.

For long, the B2B side of the business, Onninen, continued to grow. However, for the last six months, Onninen has also been dragged to declining revenues, albeit to a very small decline (-0,5% & -0,7%). The bigger issue has been the gradual profitability decline within the B2B business. The profits have not declined as heavily as in the B2C business. Still, the profit margin has dropped from 6,5% to 3,8%.

Geographically, all of the central regions for Kesko DIY have been declining similarly.

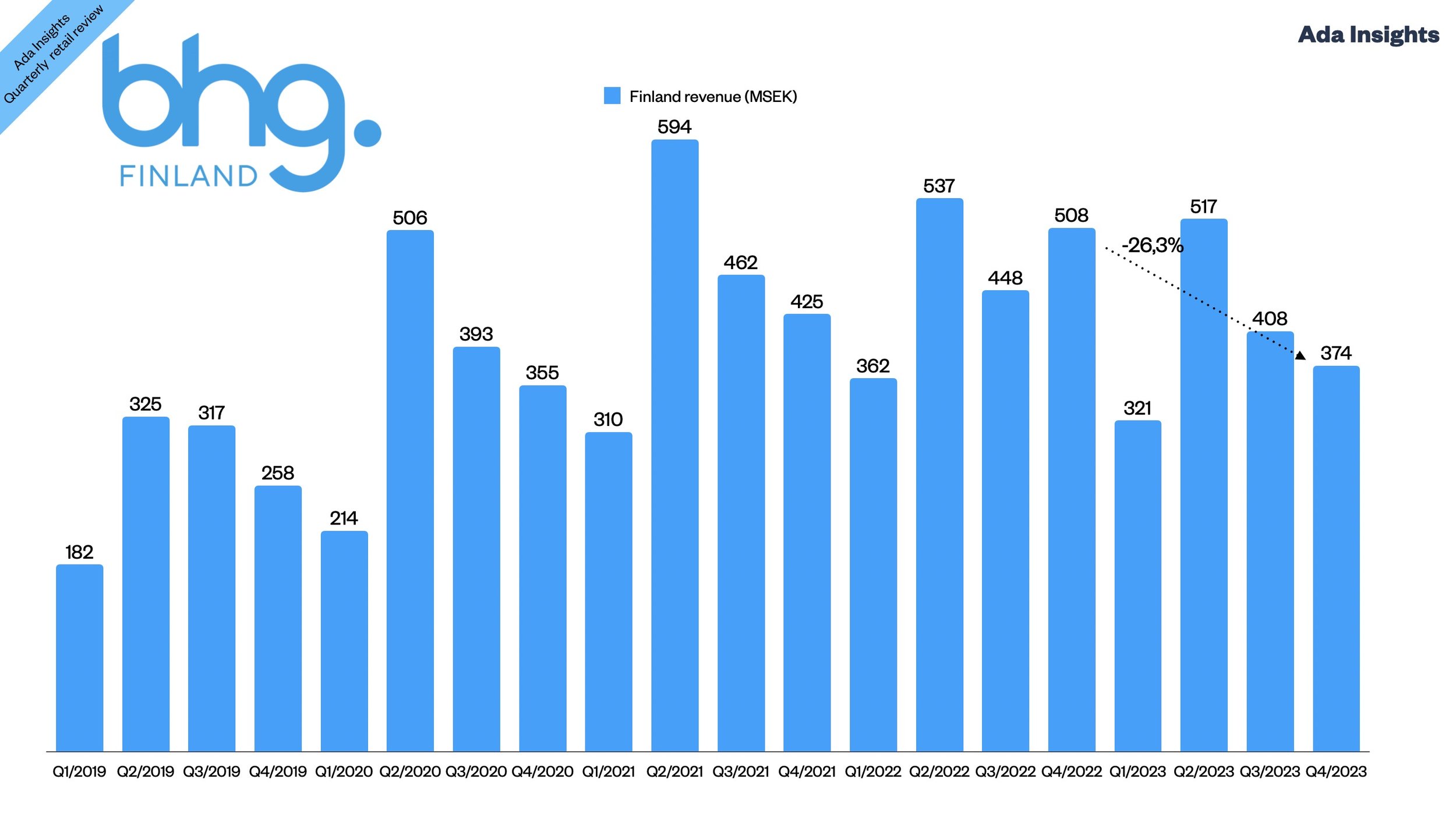

BHG is struggling to gain neither growth nor profitability

The Swedish online DIY pure-play retailer has struggled similarly with the challenging trading environment as Kesko DIY. The only slightly bright spots for BHG have been the “Rest of the World” and “Premium Living” segments. Premium Living

The five-quarter-long decline (seven for Organic growth, not including acquired companies) has heavily influenced the profitability of BHG.

During the last six months the company has generated a combined 1,8 billion SEK in operating losses.

This includes some divestments of companies that have been acquired and is heavily skewed to Q3/2023 when BHG reported an operating loss of 1,3 billion SEK.

In terms of countries, the other Nordic countries continued to decline heavily, Finland even accelerating heavily. The drastic changes in Finnish growth rates might partly explain the currency changes between the SEK and the Euro.