Amazon reports an unparalleled quarter of growth and profits

Who said Amazon can't generate retail profits?

Amazon.com reported another strong quarter of improving growth, especially record high operating income. The Operating income improved a staggering +380% from a year ago. Q4/2023 was only the second time the company reported a quarter operating income exceeding $10+billion. The previous operating income record ($8,8 billion in Q1/2021) was during the peak pandemic.

The growth in operating income was driven by the North American unit, which saw an operating income of almost $6,5 billion. This is almost double the level that the company saw during the pandemic.

New CEO Andy Jassy has proved himself in taking the profits out of the company.

To put a finer point on the profitability of the North American unit of Amazon, it is on the same level as the quarterly operating incomes of the entire Walmart. Thus, one can say that Amazon retail is now as profitable as Walmart in absolute dollars. The operating margin of Amazon retail is higher than that of Walmart.

The strong profitability has not hindered growth

The most astonishing part of Amazon’s profitability is that the company has been able to accelerate growth. The most noteworthy part is the growth of the North American unit, which grew by 13% (the same level of growth as AWS) from a revenue level of $93 billion in the previous year.

This growth took the North American unit beyond $100 billion in revenues for the first time.

The international segment continued to be the growth driver for the company, with 16,8% growth. However, the International growth is still producing significant losses for the company. During the Last Twelve Months, the International unit produced losses of $2,7 billion. The almost $15 billion operating income the North American unit generated offset this.

Services driving growth and profits

The real driver of profitable growth for Amazon continues to be the service part of the business. Services represent 55% of revenues for the company (and probably a much more significant share of profits). They also keep outgrowing the product sales with 8,8% growth of product sales against 18,5% for the services.

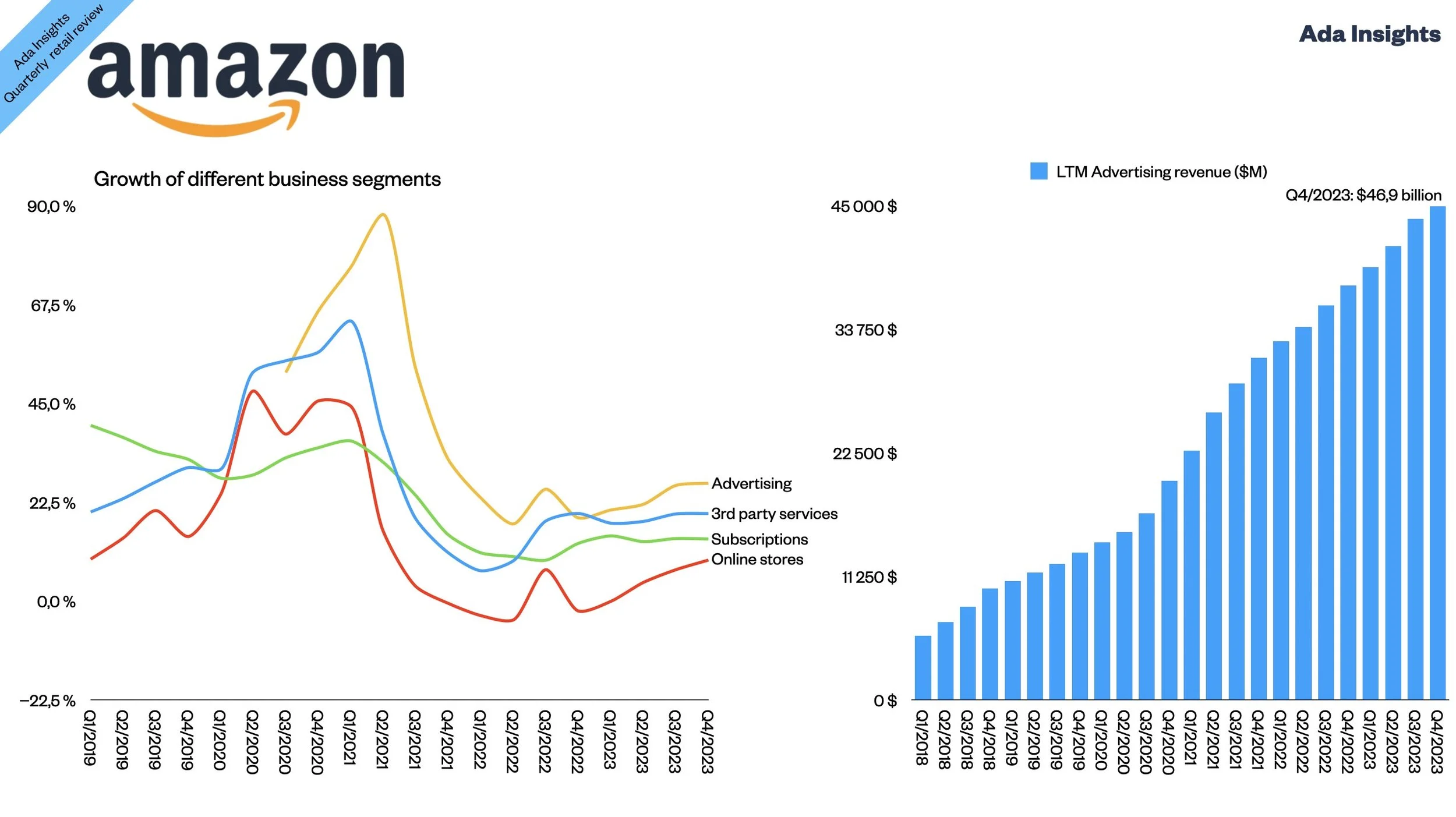

The most significant service segment continues to be the 3rd party services, which also grow at a stunning rate of 19,9%, considering that the segment already generates north of $140 billion in annual sales. The growth rate of 3rd party services is exceeded only by the red-hot Advertising segment.

Advertising revenues grew by +26,8%, a fifth consecutive quarter of accelerating growth. To put the growth of the Ads business in context, it is already 50% bigger than only two years ago and 230% bigger than four years ago (before the pandemic).

The highly profitable Ads business already generates 8,6% of all Amazon revenues. Some argue that the Ads business generates more profits with $46,9 billion in annual revenues than AWS, which produces $24,6 billion in annual operating income from revenues of $87,9 billion.

Ads would need to generate an operating margin of 52% to generate more operating income than AWS. That would not be too high of an operating margin for an Ads business.

Efficiencies in logistics and inventory help drive profitability

The other part of the profitability coin is the costs that the company has been able to keep in check. As the company continues to grow fast, it has been able to keep the growth of logistics costs lower.

Especially notable is how much faster the fees from 3rd party services are growing compared to shipping and fulfilment costs. For six quarters in a row, the 3rd party service revenues have grown faster than the costs of operating them. 3rd party service fees cover already 81,5% of the logistics expenses of the company.

This cost control was implemented at a time when Amazon seriously improved the speed of fulfilment. As the CEO Andy Jassy communicated in the quarterly earning report:

“Expansion of same-day facilities where in the U.S. in the fourth quarter, we increased the number of items delivered the same day or overnight by more than 65% year-over-year. As we’re able to get customers’ items this fast, it increases the number of occasions that customers choose Amazon to fulfill their shopping needs.”