Oda/Mathem with mixed results after meager growth in Sweden

The first public reporting of the combined Oda/Mathem business saw the old growth trends continue: Oda grew steadily in Norway, and Mathem struggled to keep up with the competition in Sweden.

Kinnevik, the investment company reporting the revenues of Oda/Mathem, expects ”Norway (Oda) to grow by 15% in 2024, with low near-term expectations in Sweden (Mathem).”

Oda's steady growth probably makes it a significantly more important part of the combined company. With the double-digit growth, Oda can soon surpass the ”old” revenue levels with the Finnish and German operations still in place.

The combined valuation of the two companies is a bit less than the combined valuation of the two companies in Q2/2023. This is a far cry from the valuations of either of the companies during the pandemic. Kinnevik justified the merge as follows:

”we supported the merger of Oda and Mathem. The merger provides an improved financial and operational outlook relative to the stand-alone options”

Mathem is the bigger challenge

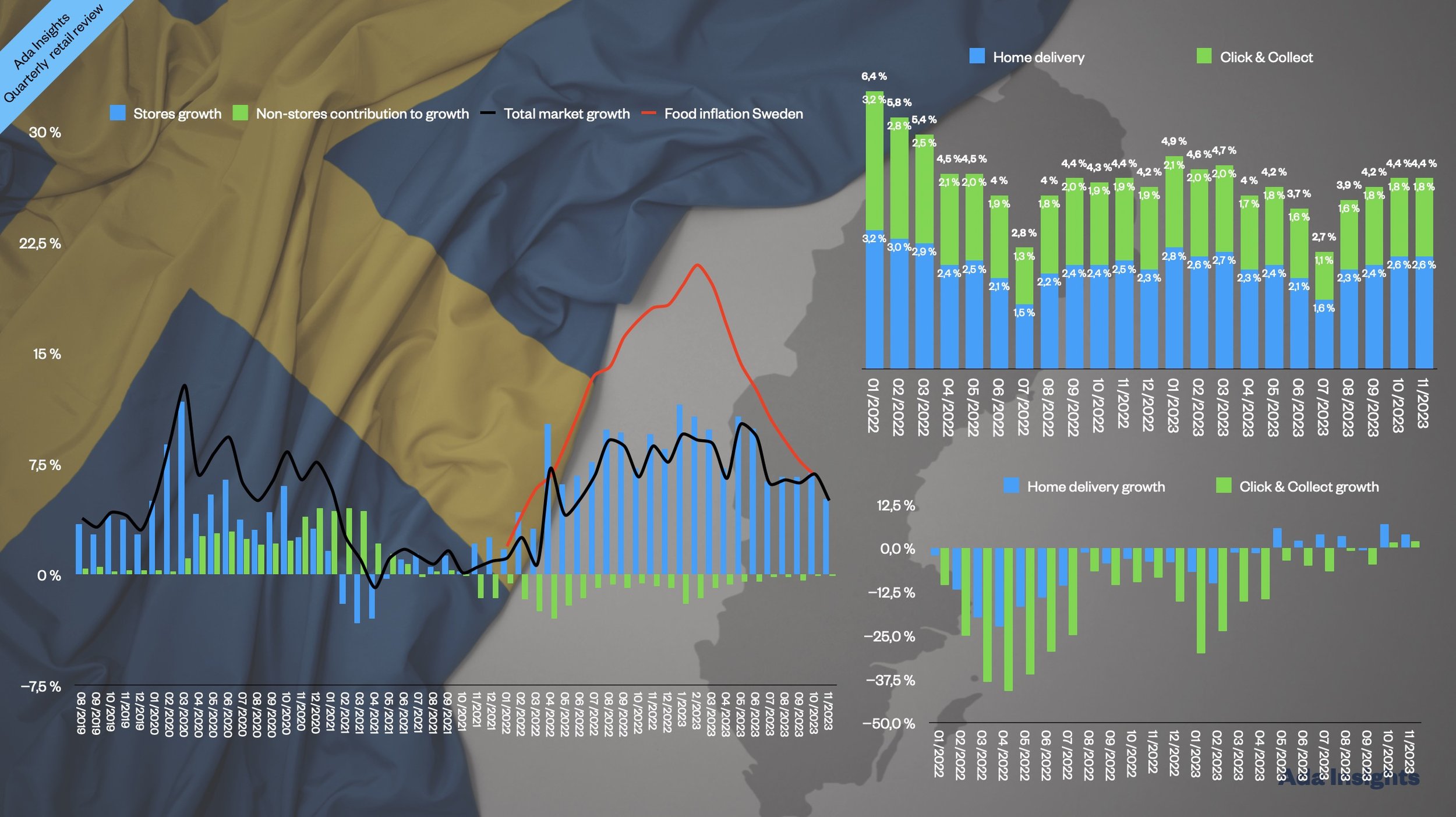

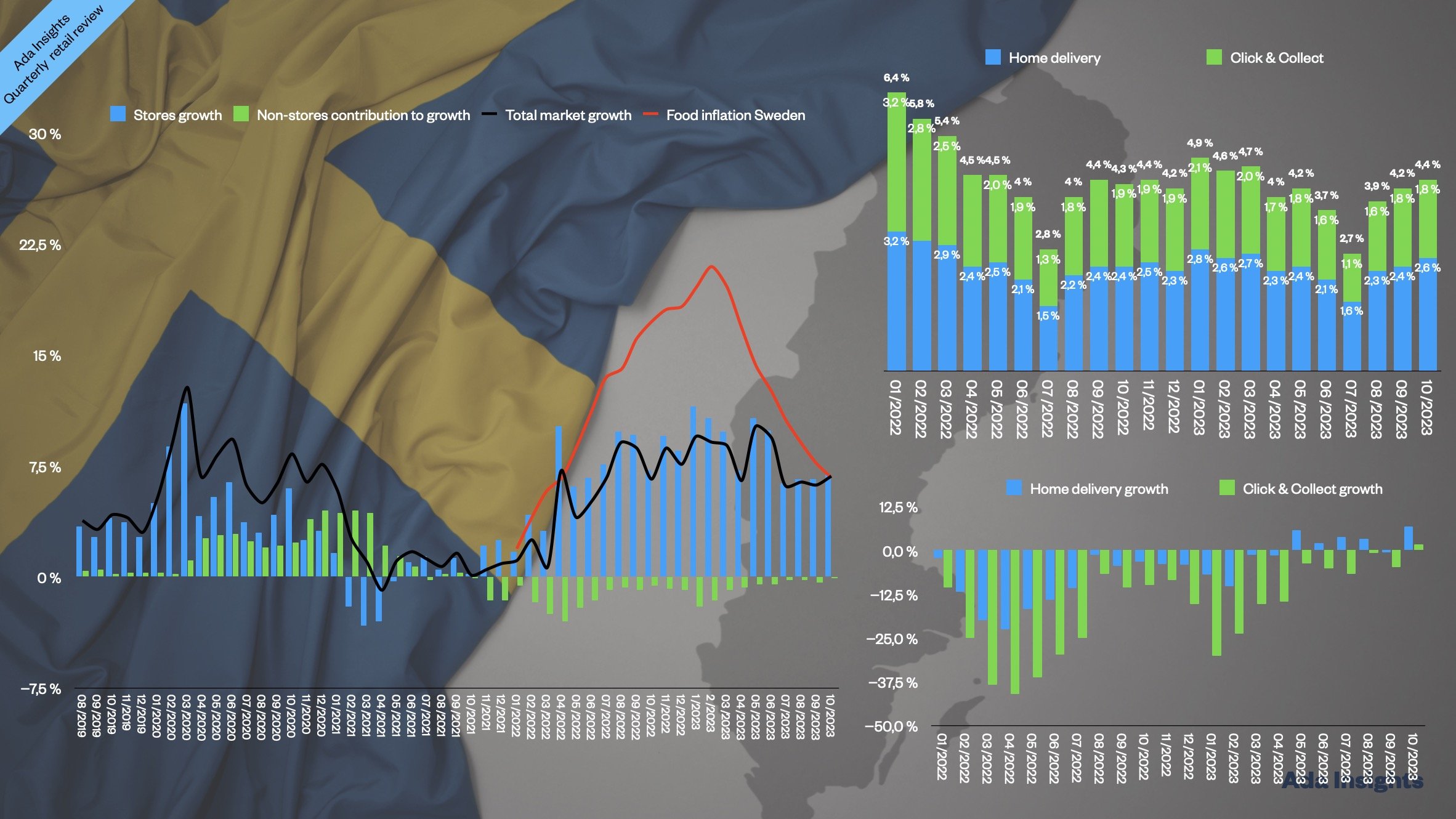

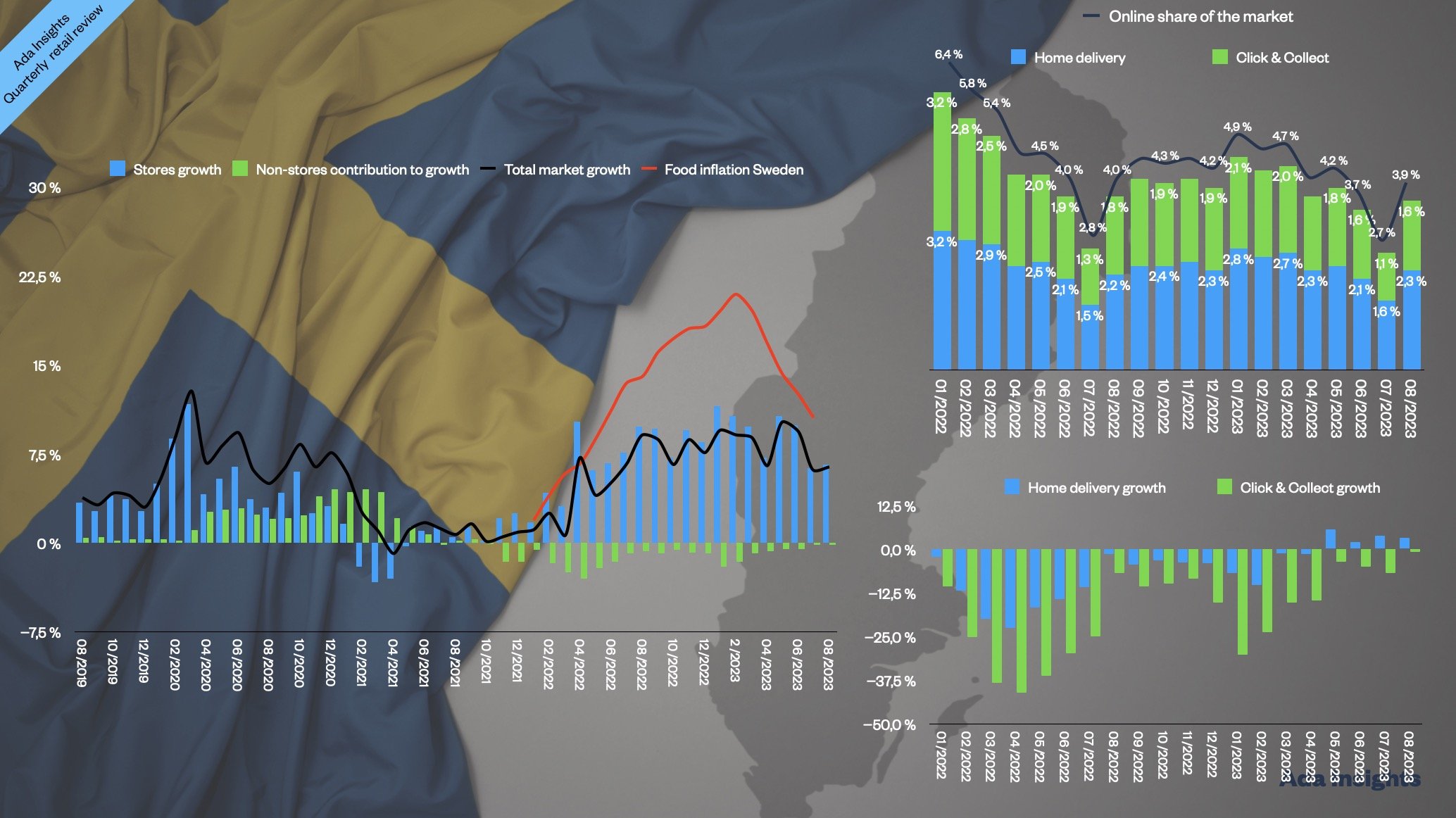

Mathem's decline is problematic because the online market in Sweden has started to rebound back to growth. Similarly, the main online grocers, ICA and Axfood, have seen their Last-Twelve-Month (LTM) revenue decline to plateau and gradually get smaller during 2023.

After the pandemic lockdowns ended, Mathem’s revenue declined less than for the market or the leading competitors. However, Mathem has not been able to bounce back towards growth. This is even though the market for online grocery home delivery in Sweden, based on the statistics from the Dagligvaruhandel, has shown growth.

Axfood has been the first online grocer to report growth in Sweden. Their online grocery revenues have grown (excluding the impact of mat.se) for three consecutive quarters, outpacing the market healthily.

Will Nemlig become the third wheel in the partnership?

The third big Nordic online grocery pure player, Nemlig, has been struggling to regain growth, especially profitability. For the latest fiscal year ending in July 2023 the company reported a meagre growth of +1,4%. Better than for Mathem, even though the previous year Nemlig revenues plummeted by -22,7%.

The bigger problem for Nemlig has been the chronic unprofitability of the company. Since 2018, the company has generated 55 million € of EBITDA losses. Only during the height of the pandemic in 2020/2021 could Nemlig report an EBITDA profit of 3,1 million €.

This has pegged some in Denmark to ask whether anyone still believes in Nemlig.

This is another similarity between Nemlig and Mathem. Oda has also struggled to reach profitability. However, the company's CEO, Karl Munthe-Kaas, has said that the company has had positive EBITDA months. For this reason, Oda is changing Mathem operations to become more efficient in the new company and showing the way to profitability.

This begs the question of whether Nemlig will become the third leg of the stool to create a Nordic online grocery giant. The combined revenues of the three companies would be 773 million € and start to approach the one billion € mark.

This would generate much buying power and efficiency in the supply chain.