Grocery retailing in Sweden: Three points from Q3/2023

As the Swedish Food Retailers Federation reported fresh numbers for September and Q3/2023, here are three main highlights from the figures.

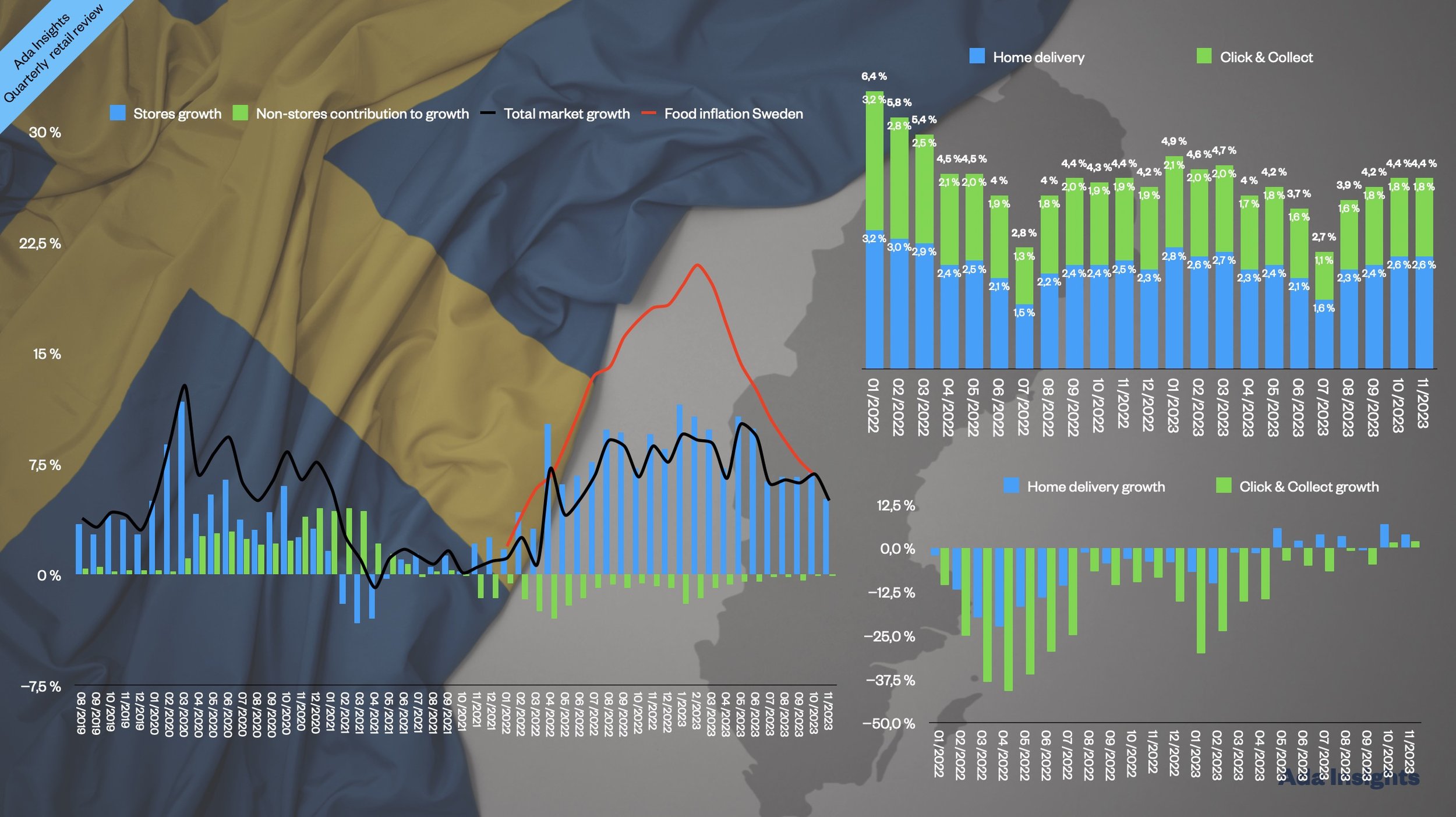

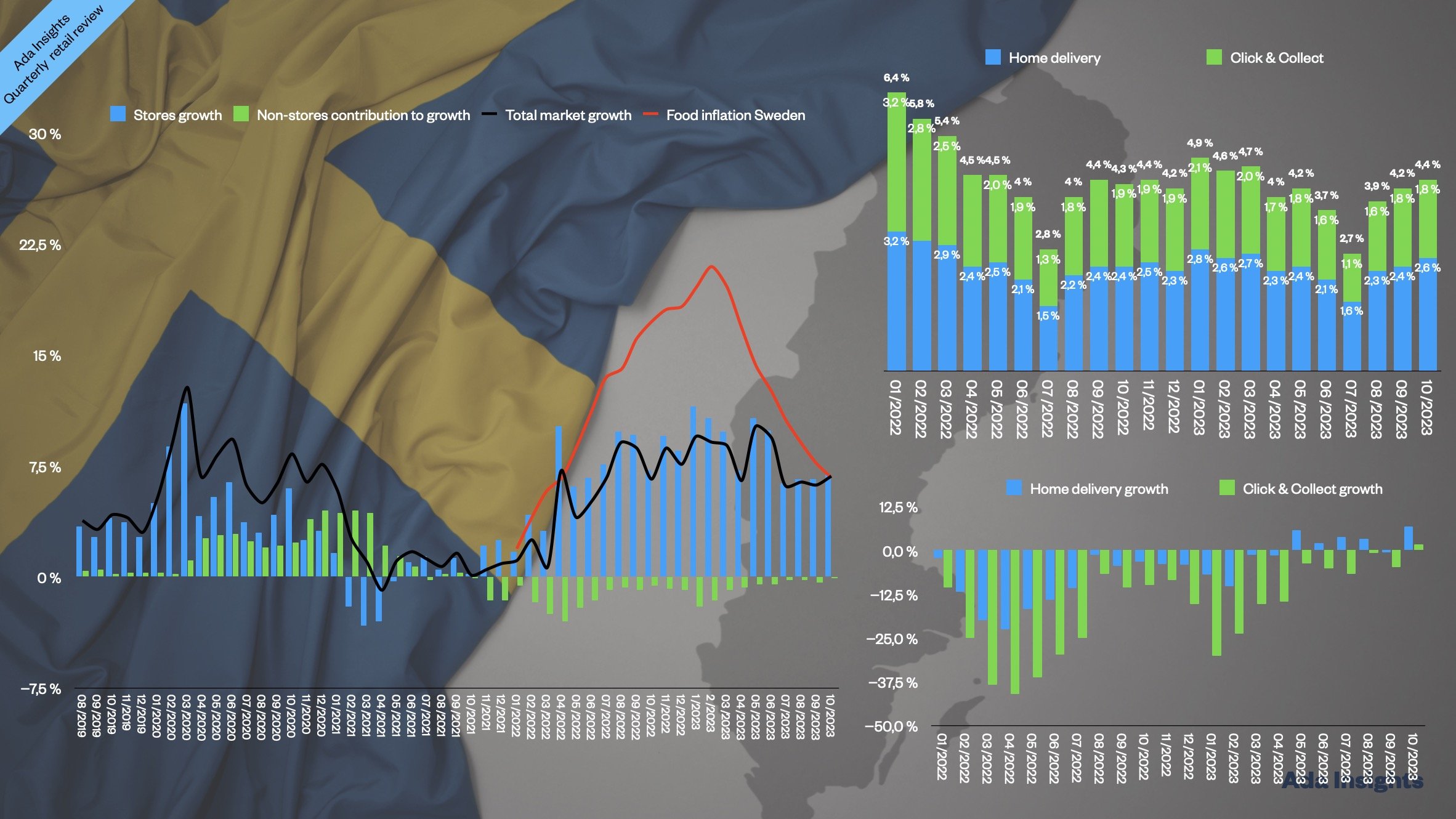

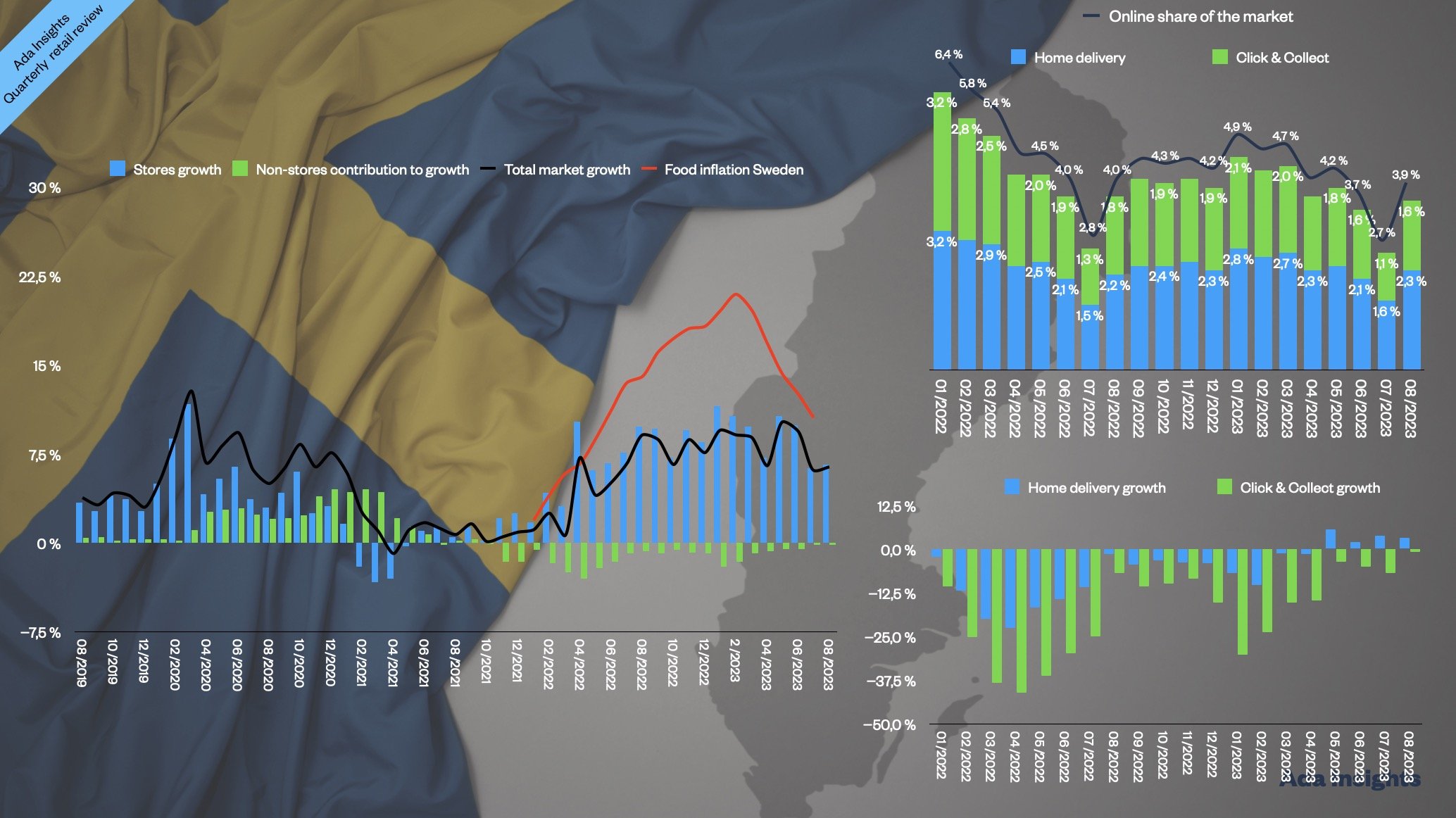

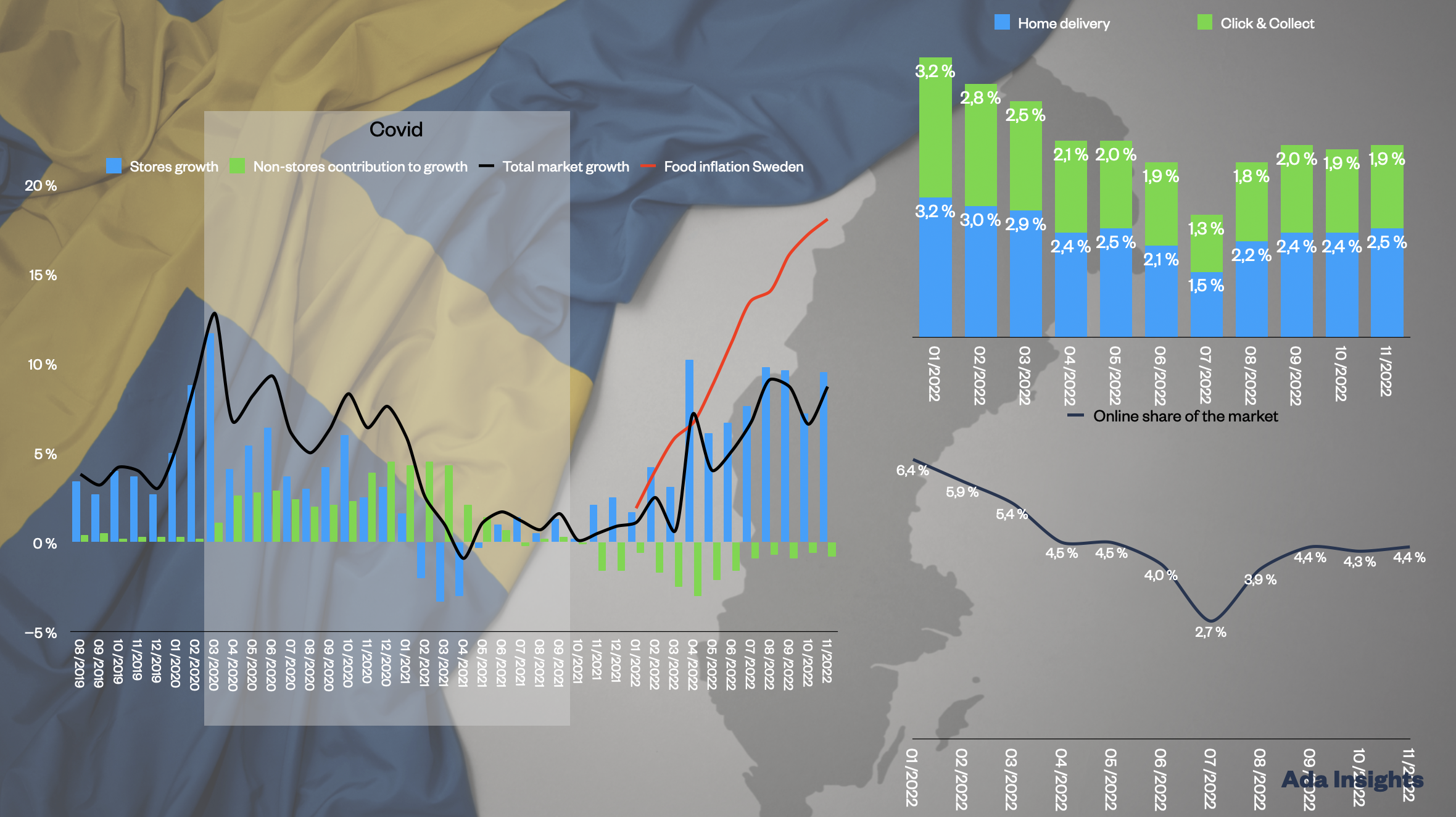

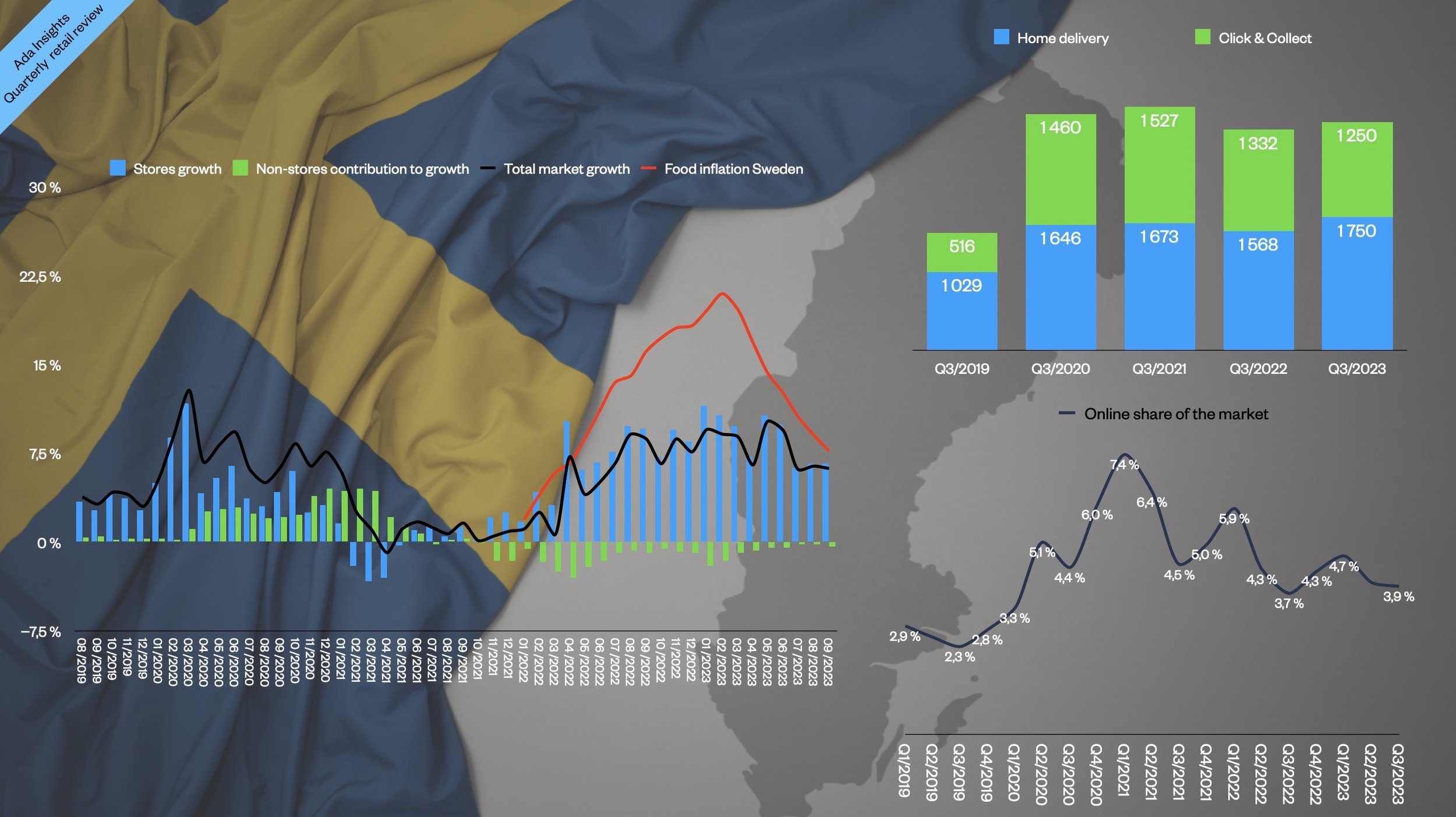

1. Volume decline slowing as inflation eases

Food inflation continued to decline. The 7,7% inflation is lowest level since April of 2022. The decline in inflation has resulted in the decline fo the volume decline for gorcery retailers as the overall grocery growth remained around 6%. It remaines to be seen how the overall growth of the industry will react to the declining inlfation. When will the volumes start to increase again?

The big question is who will be the in the position to gain from the declining inflation and the relieved pressure from the price growth? Will the rapidly growing discounters Willy’s and Lidl continue to flourish or has ICA been able to turn the corner to growth?

2. Online growth driven by home delivery

The high inflationary time has been difficult for online grocery retailing, which has seen big declines in sale since the pandemic peaks. However, lately the home delivery market has seen nascent return to growth. In September also home delivery turned to decline, albeit a very small decline (-0,7%). The full third quarter saw home delivery revenues grow, for the second consecutive quarter.

In fact, home delivery revenues reached the highest level since the recording of data started in 2019.

The last quarter had higher home delivery sales than even the pandemic Q3/2020 or Q3/2021.

The gorwht of home delivery has pulled the overall share of online of all grocery sold back to growth. For Q3/2023 the share of sales coming from online was 3,9%, almost 70% higher than pre-pandemic Q3/2019.

3. Click & Collect to its lowest level since the start of the pandemic

The biggest declines for grocery retailing has been seen in the Click & Collect segment. Since Q4/2021, Click & Collect revenues have declined rapidly, even though the decline rates have come down to only -3,9% during this quarter. Currently, Click & Collect represents 1,5% of all groceries sold in Sweden.

For the last quarter of the year, the online channel continues to take a bigger share of the market. It will be interesting to see how much of that will go to home delivery. For the Last Twelve Months home delivery represented 57% of all online grocery orders. This is stil ldown from the pre-pandemic 66%, but significantly higher than the 49% during the pandemic.